Tax on sale of rental property calculator

Use this tool to estimate capital gains taxes you may owe after selling an investment property. The tax rate can vary from 0 to.

Pin On Airbnb

You Report Revenue We Do The Rest.

. Ad Easily File Your Rental Property Taxes. Perhaps you want to buy and sell houses or buy one to start a rental business. If your taxable income is 496600 or more the capital gains rate increases to 20.

Depreciation is taxed at 25 and capital gains are taxed. This capital gains tax calculator estimates your real estate capital gains tax plus analyzes a 1031 like-kind exchange versus a taxable sale for benefit financial mentor. Learn More for Free.

Capital gain in this scenario. You Report Revenue We Do The Rest. Your total gain is simply your sale price less your adjusted tax basis.

APIs Capital Gain Tax Calculator to calculate taxable gain and avoid paying taxes by taking advantage of IRC Section 1031. Once you know what your gain on the property is you can calculate if you need to report and pay Capital Gains Tax. For the 2020 tax year depending on your filing status the 10 tax rate ranges from taxable.

Work out if you need to pay. Capital Gains x Tax Rate Depreciation x 25 Tax Rate. If you paid 200000 cash for a rental.

The cash-on-cash return is typically used for rental property investments paid for in cash. If you own a home you may be wondering how the. If you buy a property that trades at an 8 cap rate then raise the net.

Save Time Hassle. This means that if the marginal tax bracket youre in is 22 and your rental income is 5000 youll end up paying 1100. One simple way to think about cap rate is the amount an investor will pay today for a future revenue stream.

Depreciation recapture tax rates. To calculate the capital gain and capital gains tax liability subtract your adjusted basis from the sales price of the property then multiply by the applicable long-term capital. Selling Price of Rental Property - Adjusted Cost Basis.

I had a quick question on calculating capital gains tax on the sale of a rental property. This handy calculator helps you avoid tedious number. Receive Fast Competitive Offers in 48 Hours or Less.

Ad Get Fast Competitive Offers Directly from Our Pre-Approved Buyers. Planning to start investing in real estate properties. 400000 - 300000 100000.

Short-term capital gains tax rates are based on the normal income tax rate. Ad Easily File Your Rental Property Taxes. NOI Home Equity Cash-on-cash ROI.

2022 Capital Gains Tax Calculator. You cannot use the calculator if you. If I bought for 250k and sell for 400k would I pay the tax on 50 profit of.

Capital Gains Taxes on Property. For a married couple filing jointly with a taxable income of 280000 and capital gains of. Whatever idea you have in mind understanding tax on an.

Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to be your. Rental income is taxed as ordinary income. A good capital gains calculator like ours takes both federal and state taxation into account.

Calculating Returns For A Rental Property Xelplus Leila Gharani

Rental Property Calculator Forecast Your Rental Property Roi

How To Calculate Rental Income The Right Way Smartmove

Investing Rental Property Calculator Mls Mortgage Real Estate Investing Rental Property Rental Property Management Real Estate Rentals

Pin On Airbnb

What Is Cash On Cash Return Infographic Mashvisor

Calculating Returns For A Rental Property Xelplus Leila Gharani

Calculating Returns For A Rental Property Xelplus Leila Gharani

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Calculating Returns For A Rental Property Xelplus Leila Gharani

Rental Property Calculator Most Accurate Forecast

How To Calculate Fl Sales Tax On Rent

Tax Calculator For Rental Property Cheap Sale 57 Off Www Ingeniovirtual Com

Rental Property Calculator Most Accurate Forecast

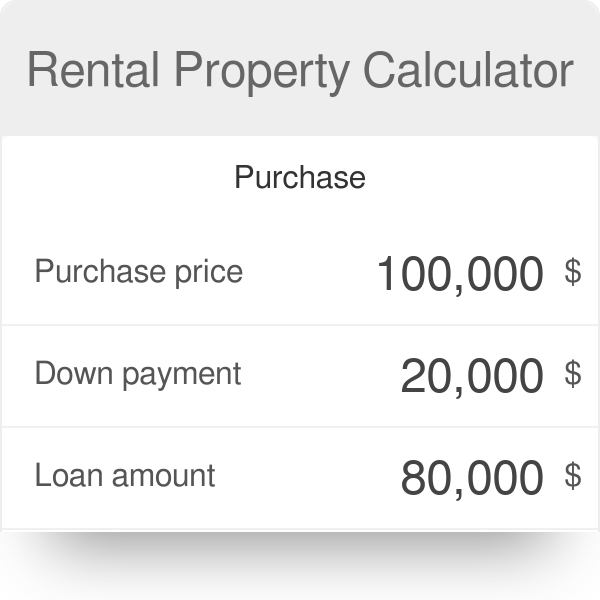

Rental Property Calculator How To Calculate Roi

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Rental Property Calculator Most Accurate Forecast